You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hey Nerds: Blockchain

- Thread starter zeke

- Start date

CH1

The Artist Formerly Known as chiggins.

CBII heard me. Strong close, back to 0.30.

not a bad presentation by CBII

[video=youtube;926PzCEEYpc]https://www.youtube.com/watch?time_continue=9&v=926PzCEEYpc[/video]

Preston

MBow30 alt account

not a bad presentation by CBII

[video=youtube;926PzCEEYpc]https://www.youtube.com/watch?time_continue=9&v=926PzCEEYpc[/video]

Feels a lot like a no-brainer to me. Interested to see where it's headed. If I'm wrong, it wouldn't be the first time but I've never felt more comfortable/confident in an investing decision in my life.

Which probably means I'm doomed.

LeafGm

Well-known member

I haven't ordered any myself, but I hear nothing but bad things.Fu cking government shitshow. Can't even make money selling drugs.

Ontario Cannabis Store expects CA$25 million loss despite monopoly advantage.

The bud they ship you is old and dried out.

Takes forever for you to get the product you ordered.

The product itself is mediocre at best.

Comes with an insane amount of plastic packaging.

The amount they actually ship you is always less than what you actually paid for.

...basically, this is what happens when the government muscles out anyone with actual expertise in growing, selling or even using Cannabis, and has the show run by a bunch of ex-cops who crusaded against legalization (like Julian Fantino), ex-LCBO employees and patronage appointments.

And not to mention that to actually buy from the OCS, you have to use your name, credit card & address, and have it on record that you consume a drug that's still illegal in a lot of countries, and which can get you banned from even entering such countries (like the United States). And we have a government that's more than happy to share all of our private information with these countries, so it's not like you can be confident that your privacy is protected if you purchase from the OCS.

Preston

MBow30 alt account

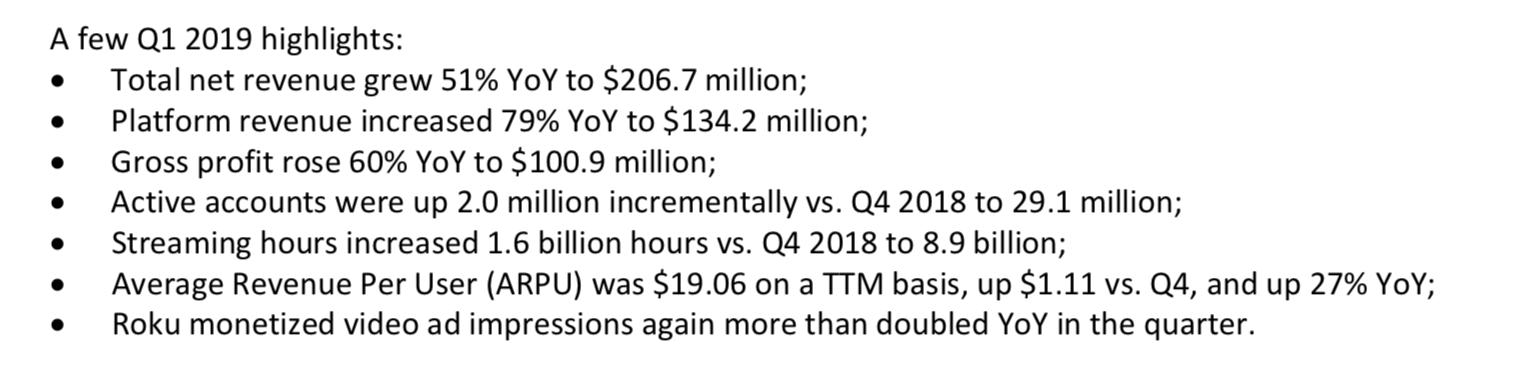

CBII released their earnings this aft. 2018 Revenue in Excess of C$10.7 Million

Executing exactly as expected and as promised. I was pretty positive that the earnings would look like this but it's good to see confirmation of that.

HabsFan1

Well-known member

CBII released their earnings this aft. 2018 Revenue in Excess of C$10.7 Million

Anyone have a projection as to what one should expect out of this company.

Preston

MBow30 alt account

Anyone have a projection as to what one should expect out of this company.

Long play. For me the verdict is out on how big they can be. Lots of factors involved. Should be good for 20 mil in revs next year if they execute. Terrific margins. Current market cap of just under 30 mil. A steal at these levels. The market can stay irrational for a very very very long time so there are never any guarantees but I'm feeling very comfortable holding this one long and strong.

CH1

The Artist Formerly Known as chiggins.

Anyone have a projection as to what one should expect out of this company.

what preston said. They lay out their strategy in a transparent fashion in the video I posted earlier. Their focus is not cannabis as lifestyle, but cannabis as medicine that will require data to help doctors, drugs companies and insurance companies. It's not a big position for me, but I like the risk reward. It's in my low cost speculative basket that also includes IN, EMBI and VIDA.

Volcanologist

Well-known member

Fu cking government shitshow. Can't even make money selling drugs.

Ontario Cannabis Store expects CA$25 million loss despite monopoly advantage.

:lol

I knew it would suck. Their website is garbage and their products pedestrian at best by today's standards. Surprise!

Preston

MBow30 alt account

Yeah so I bought some more CBII today. The current market cap does not make much sense to me. Either I'm being fooled or this was the easiest play of my life. It's close to a fairly strong support level so I'm thinking it's a bottom fishing play on one hand... But on the other hand I don't think I can justify selling at anywhere close to these levels so I'm probably long on this position.

Q1 earnings at the end of the month. They have been executing exactly as they have projected so I'm not expecting a dropoff there. Selling pressure seems weak atm. Only thing that's missing is buyers. Need some hype. May have to go through a summer laul before we see real returns but I cannot see how anything lower than these levels is even remotely justifiable. As goofy and nonsensical as the stock market can be sometimes... That just straight up wouldn't make sense.

Either way I'm rolling with the punches.

Q1 earnings at the end of the month. They have been executing exactly as they have projected so I'm not expecting a dropoff there. Selling pressure seems weak atm. Only thing that's missing is buyers. Need some hype. May have to go through a summer laul before we see real returns but I cannot see how anything lower than these levels is even remotely justifiable. As goofy and nonsensical as the stock market can be sometimes... That just straight up wouldn't make sense.

Either way I'm rolling with the punches.

MindzEye

Wayward Ditch Pig

I bought some TNY today. I like the chart.

Just a nibble eh? I think I see your order.

A shit ton of news is expected to drop shortly and she's been playing up in anticipation. But yeah, the chart looks a lot better than it did a couple of months ago. Welcome aboard.

CH1

The Artist Formerly Known as chiggins.

Just a nibble eh? I think I see your order.

A shit ton of news is expected to drop shortly and she's been playing up in anticipation. But yeah, the chart looks a lot better than it did a couple of months ago. Welcome aboard.

just dipped my toe in the water... amazing day today. Got my Chinese puts working, and lucked out with APHA calls I bought yesterday. And a bunch of my stocks are green after smashing their earnings -- PINS, RDFN, MOBL. My only stinker is NVTA.

I'm holding a lot of cannabis plays, but if all the texts I'm getting about "should I sell my pot stocks" are any indication, I think we might be close to a nice surge.

MindzEye

Wayward Ditch Pig

just dipped my toe in the water... amazing day today. Got my Chinese puts working, and lucked out with APHA calls I bought yesterday. And a bunch of my stocks are green after smashing their earnings -- PINS, RDFN, MOBL. My only stinker is NVTA.

I'm holding a lot of cannabis plays, but if all the texts I'm getting about "should I sell my pot stocks" are any indication, I think we might be close to a nice surge.

Cannabis is cyclical, sucks from April-August. TNY is my only cannabis hold through the summer, she's marching to the beat of her own drummer based on actual business developments and not the rest of the market. I'm sitting on some dry powder that I'll go looking to place to be ready for September. APHA shocked the shit out of me though with that quarter. After the gong show they've been in 2019, I was not expecting that at all. Planning on doing some deeper diving on OGI, FIRE, CWEB, SNN shortly. That's my preliminary shortlist for the fall. May have to see if this APHA gap up is going to reverse trend on them or not, she's been ugly since April. Waiting to see if ACB reverses as well, she could cruise back into the 8-9 (USD) range without much of a push.